Semiconductor maker Advanced Micro Devices stock jumped in after-hours trading Tuesday, after the company reported its data center sales doubled. The company also boosted its full-year forecast amid a global chip shortage.

AMD (ticker: AMD) shares advanced 4.2% in the extended session.

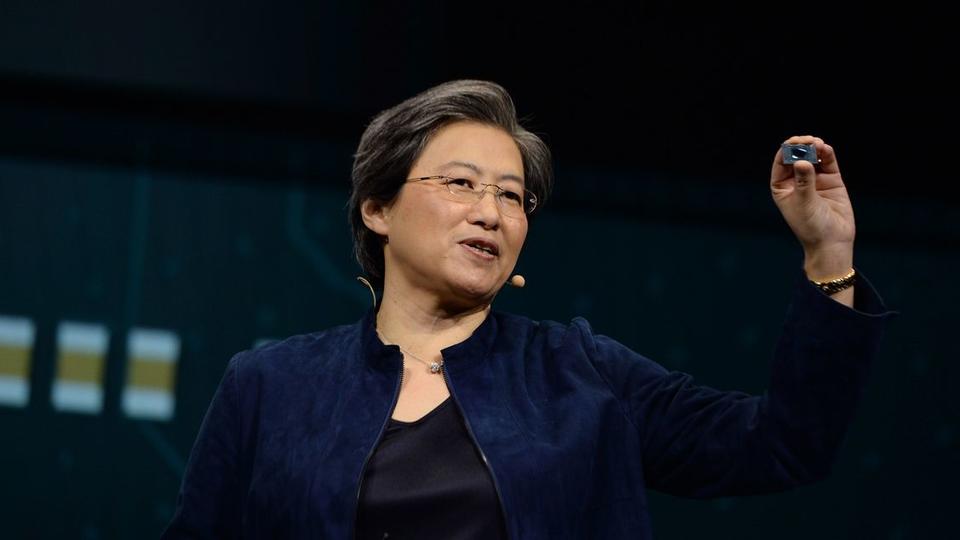

In contrast to Intel (INTC), which saw a sharp decline in its data center group when it reported earnings last week, AMD Chief Executive Lisa Su said that AMD’s data center chip revenue more than doubled in the first quarter.

AMD reported first-quarter net income surged 243% to $555 million, which amounts to 45 cents a share, compared with $162 million, or 14 cents a share a year ago. Adjusted for stock-compensation, and acquisition related costs, among other things, earnings amounted to 52 cents a share. Revenue rose to 93% to $3.45 billion.

The consensus adjusted earnings estimate was 44 cents a share, on sales of $3.21 billion.

“We had outstanding year-over-year revenue growth across all of our businesses and data center revenue more than doubled,” Su said. “Our increased full-year guidance highlights the strong growth we expect across our business based on increasing adoption of our high-performance computing products and expanding customer relationships.”

The company’s segment that accounts for personal computer and graphics processor sales—including those destined for servers—grew revenue 46% to $2.1 billion. AMD says its growth was largely from selling its Ryzen chips and Radeon graphics processors and the average selling price of both types of products increased.

Data center sales from AMD are lumped into a reporting segment that also includes chips destined for videogame systems, such as the ones AMD designed for the new consoles made by Microsoft (MSFT) and Sony (SNE). Combined, the segment reported revenue rose 286% $1.35 billion, because of new videogame systems launched in November and its most advanced server chips.

“We have established AMD as a trusted, strategic partner to the largest cloud, enterprise, and [high performance computing] customers based on developing and consistently delivering a leadership, multi-generation CPU road map,” Su said.

Despite the year-over-year growth in the segment, Su said in prepared remarks for the conference call late Tuesday that its semi-custom revenue declined by a single digit sequentially. But, that decline is an improvement over the typical seasonality, where new console sales drop off after the holiday season.

Su told Barron’s in an interview Tuesday that the company expects strong sales through the rest of the year, but it will likely take roughly three years to achieve very optimized production for videogame system chips. Doing so makes sense, Su said, because the console cycle is much longer than other consumer products, such as personal computers.

AMD increased its full-year guidance amid a global shortage of semiconductors that has placed immense strain on the chip supply chain. AMD said it now forecasts revenue to grow roughly 50% compared with 2020, which totals about $14.64 billion. Analysts had predicted full-year adjusted earnings of $1.94 a share and revenue of $13.54 billion.

Su told Barron’s AMD was able to boost it because a number of aspects of the company’s business worked together to increase its output: simplifying some of AMD’s own processes, reducing the logistics involved, and securing more capacity from its supply chain partners.

“It’s all of the above,” Su said. “And I would say that we’re not done at all. There is still a lot of work to do, the inventory levels that you normally see in a supply chain of this complexity are not there. So it’s very lean, there’s no buffer in the system.”

The company forecast second-quarter revenue of $3.6 billion, plus or minus $100 million. Wall Street had modeled revenue of $3.29 billion.

Su said AMD is on track to close the Xilinx acquisition by the end of the year, which it announced amid a wave of consolidation in the semiconductor industry last year.

Shares of AMD fell 0.2% to close at $85.21 during regular trading Tuesday. The PHLX Semiconductor index, or Sox, dropped 0.8% Tuesday.

Source:-https://www.barrons.com/articles/amd-doubled-its-data-center-revenue-heres-what-the-rest-of-2021-could-look-like-51619561282